Grow with Saphyte

Insurance

Insurance companies often find it a challenge to organize data, making it hard to provide quality services. That’s why we designed Saphyte to let them access needed data at their fingertips. We also let them do more— provide automated responses to clients and tracking links for referrers.

Sign up for free Book a Free Demo

Sign up for free Book a Free Demo

Case 1

Personalized Policyholder Journey

PROBLEM

Many of our clients had a problem providing a personalized journey to policyholders.

CASE

In the case of an insurance company we worked with, they want to track their customers’ journey so they can identify sales opportunities early and act on them fast.

They said that a lot of these sales opportunities were left undetected or have gone to waste simply because they were unable to keep an eye on their customers each step of the way. Some of their customer would leave unnoticed and some provided feedback that they felt the insurance product or plans given to them did not match their preferences.

SOLUTION

We solved the lack of personalized service with Saphyte. The first thing we did is we empowered our partner to utilize the lead and client management features of our software.

With Saphyte, they can add the necessary policyholder information, upload files and documents in the system (like contracts), add notes per client from previous engagements, and add schedules that would prompt the system to notify teams whenever a client qualifies for cross-selling, upselling, or renewal.

Case 2

Capturing Qualified Leads

PROBLEM

Capturing leads is a challenge to many businesses. Capturing sales-ready leads is another challenge.

CASE

A partner of ours in the insurance industry needed to capture sales-ready leads, so they didn’t have to waste money on campaigns that don’t convert. They’ve been running email marketing campaigns, but they find it very hard to track.

What’s worse is that they’ve been sending emails to leads and clients manually. And it’s taking a toll on their sales team.

SOLUTION

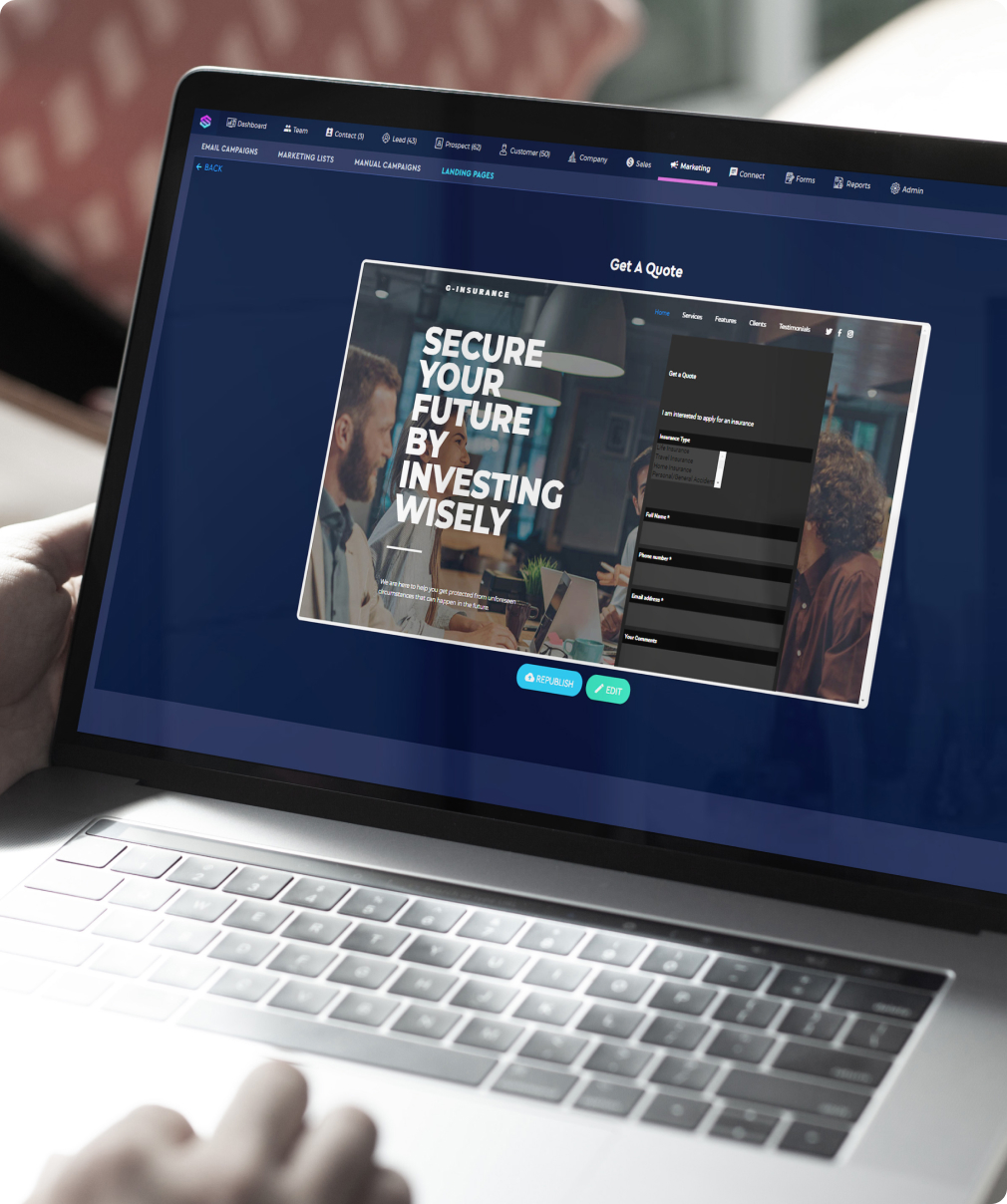

What we did was provide a roadmap that would help our partner achieve the marketing goal of capturing sales-ready leads using our CRM’s features.

First, we used a fully integrated email management system and “Bulk-and-Drip” email sequencing to attract leads that expressed their interests in our partners’ products and indicated that they’re ready to make a purchase.

Second, using Saphyte, we designed the landing pages to prompt website visitors to fill out a form whenever they’re interested in downloading our partner’s lead magnets.

Lastly, we used Saphyte to keep track of these campaigns’ performances and make decisions based on the analytics generated by the system.

Case 3

Automated Response and Tracking Links

CASE

One insurance partner we had wanted a system that provides automated responses to their customers. To them, this is important as it helps create a positive experience for their customers online. But providing continuous marketing without hiring more people seems impossible.

Moreover, our partner also wanted to capture and identify unique referrals. It’s a needed action, especially for many insurance companies, so they can reward referrers accordingly.

SOLUTION

To avoid putting more pressure on their support team, we used Saphyte to send automated reply messages so their customers stay fully informed.

Important updates, answers to FAQs, or even responding to requests are a few of the automated replies we built using Saphyte.

To address our partner’s request of tracking referrers, we used Saphyte’s form builder where referrals and tracking codes can be typed in and automatically captured in the CRM. The database then showed who referred who, letting our insurance partner provide benefits and incentives to those who deserved them.

Few of our key features which are

helping insurance firms to grow

Automatic capture and identification of unique referrals

Referrals is a cost-effective way to grow the business. Insurance companies need to identify who refers to who, and incentivize them accordingly. Using Saphyte’s form builder, referrers can input their referrals through the form and it will be automatically captured inside Saphyte CRM. Also, with the use of tracking codes, the insurance company will be able to identify the referrer.

Automated email responses

Insurance companies receive multiple inquiries daily and by building workflows in Saphyte to send automated reply messages, it will help them maintain transparent communication with their customers and keep them informed in terms of managing their queries.

Streamlined member management

Insurance companies have a huge amount of customer data and Saphyte is capable of scaling up with them. With Saphyte, insurance companies can be assured that their data is secure in one central place and they can keep track of their customer’s information, have a 360-degree view of their customer journey, and have greater control of data by revealing duplicates.

Better connections with clients

Saphyte provides a Client Portal under the Enterprise plan to help insurance companies have a better connection with their customers. The Client Portal enables customers to locate information anywhere and anytime and it reduces the demands on your customer service personnel who otherwise would be spending their valuable time on responding to requests from clients.

Timely follow up on renewals

To stay ahead of the competition, insurance agents need to be aware of when a policy is expiring and when it is due for renewal for a timely sales follow-up and upselling. With Saphyte, you can set up automated alerts where your sales will receive a notification when a contract is up for renewal months or days before and see them in a glance on your calendar.

Don’t just take our word for it

Got Questions?

We’ve got 24/7 world-class support ready to help.